In today’s business landscape, embracing technology has become imperative for companies striving to thrive. Recognizing this crucial need, the Canadian government took a bold step by introducing the Canadian Digital Adoption Plan (CDAP) in 2022.

With an impressive budget of $4 billion, the CDAP grant program offers SMEs an unprecedented opportunity to unlock their full potential in the digital age. It empowers SMEs to leverage digital solutions and establish a robust online presence with the support of digital advisors such as Customerization, serving as trusted and certified Digital Advisors.

In this article, we will guide you through the CDAP application process and eligibility requirements and also explore alternative lending solutions. Let’s dive in.

Understanding the CDAP Grant

The CDAP grant offers up to CAD$15,000 in funding to support SMEs in their digital transformation. Eligible businesses receive personalized guidance from CDAP digital advisors to assess their needs and create a tailored business automation strategy. Prior to applying, businesses are advised to evaluate their technology and operations for digital adoption opportunities.

Who Qualifies for the grant?

To qualify for the CDAP grant, your company must meet certain eligibility criteria. For starters, this includes being a for-profit, privately owned business incorporated in Canada at the federal or provincial level. Your business should have between 1 and 499 full-time employees and have generated at least CAD $500,000 in annual revenue within the past three tax years.

Eligible Expenses

The CDAP grant covers eligible expenses for engaging a Digital Advisor and producing a Digital Adoption Plan in Canada. However, note that it does not cover implementation costs or expenses unrelated to the plan production.

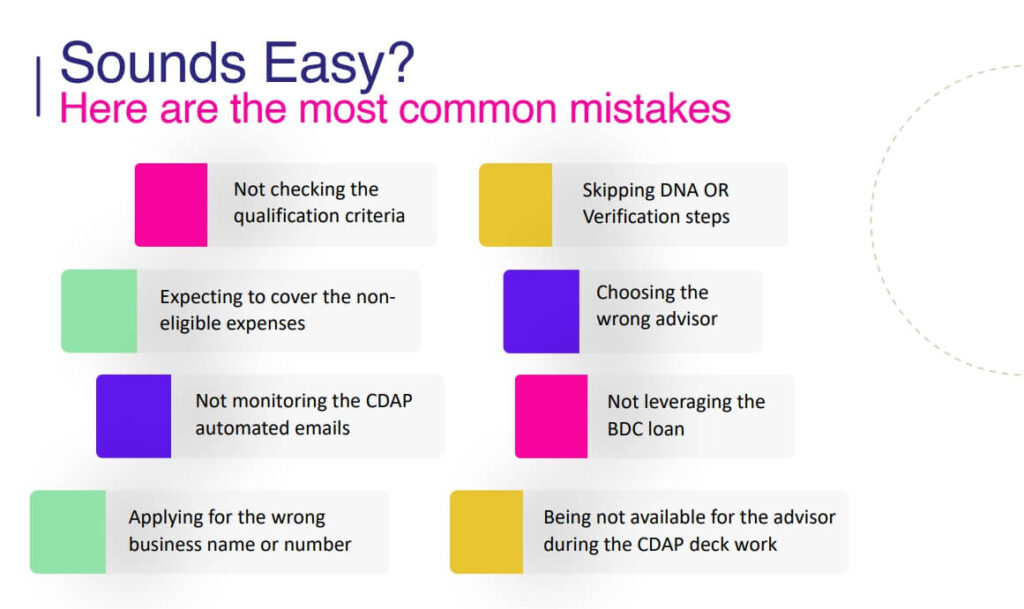

Navigating the CDAP Application Process

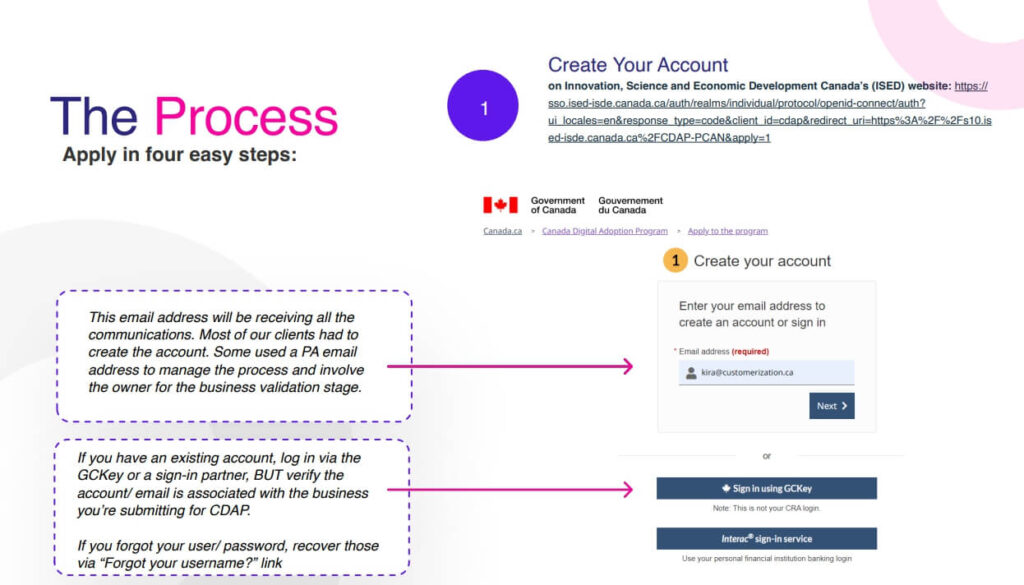

Follow these steps when applying for the CDAP grant:

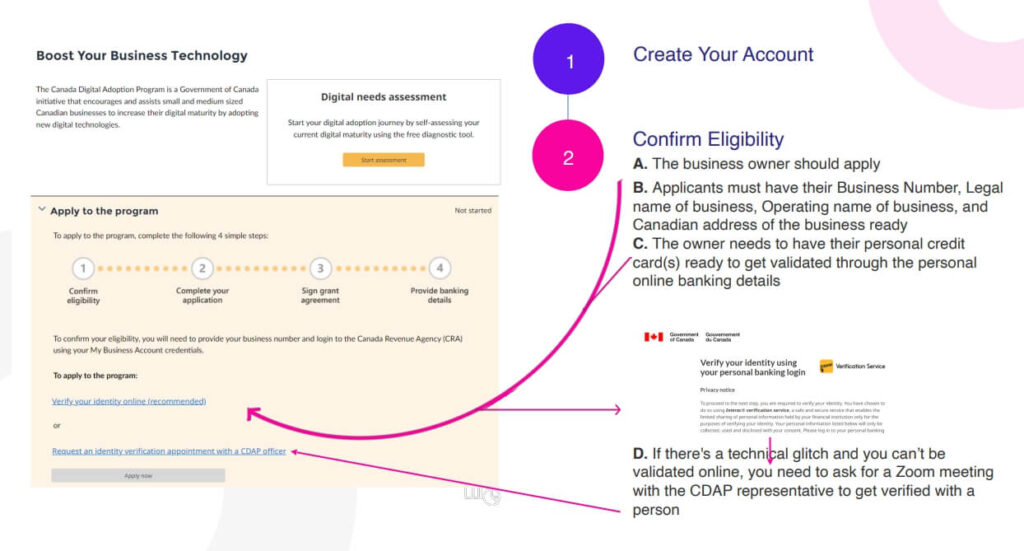

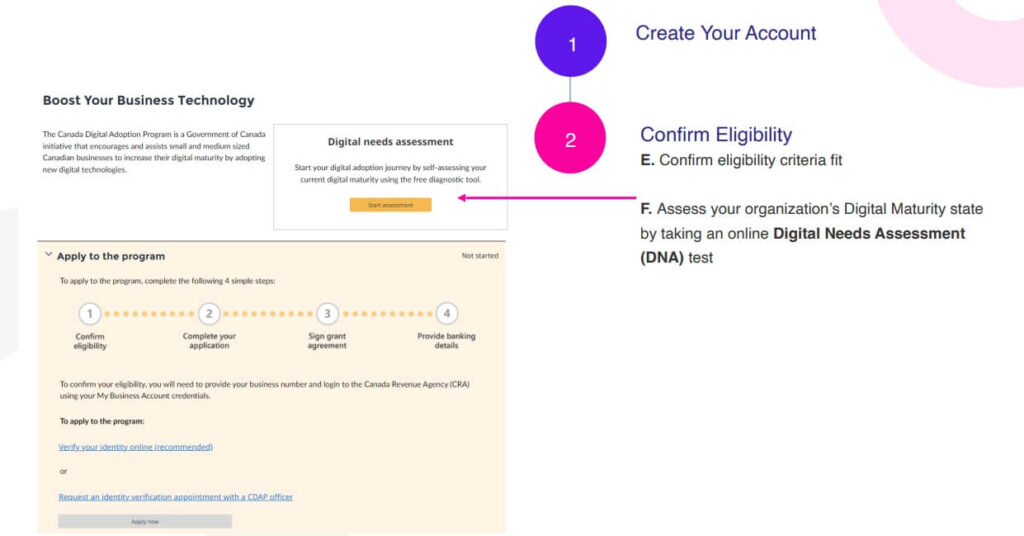

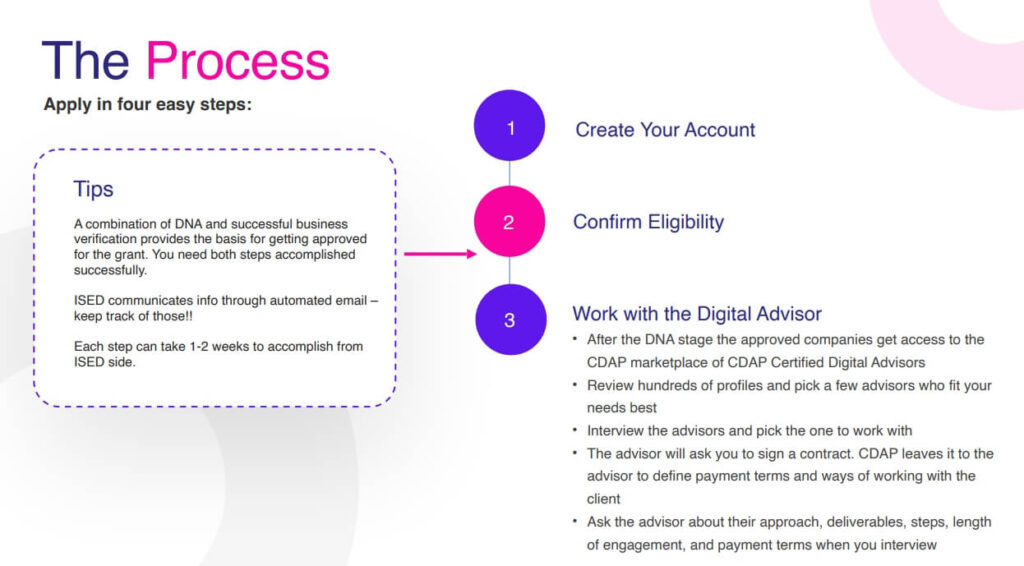

2. Confirm Eligibility: To apply for the grant, the business owner must provide their business number for eligibility confirmation, complete the Application Form, and sign the Grant Assignment. They should also provide banking details, confirm eligibility criteria, and assess digital maturity with an online DNA test. They should be prepared for online identity verification or an appointment with a CDAP officer if required and keep personal credit card(s) available for online banking validation.

3. Work with the Digital Advisor: After approval, access the CDAP marketplace for certified digital advisors. Choose an advisor aligned with your business needs, conduct advisor interviews, and sign a contract. The advisor will define payment terms, the working relationship, approach, steps, deliverables, and engagement duration.

4. Collect Your Grant: Work with the advisor based on the agreed terms. They will provide two deliverables: the CDAP deck meeting all requirements and an invoice for their services. Upload these to the portal. After approval, the grant funds will be deposited into your account within 1-2 weeks. Payment to the advisor is per terms you agreed with your advisor upon. Some advisors do not require any upfront payment, and you only pay after you have receive the grant money.

Additional CDAP Funding Options

Once the business has received the $15,000 grant and worked with the digital advisor to design its digital adoption plan, there are additional funding options available for implementation.

BDC 0% Interest Loan:

Upon grant approval, businesses gain access to a zero-interest loan offered by the Business Development Bank of Canada (BDC) to fund their digital adoption plan implementation. The loan amount, ranging from $25,000 to $100,000, depends on the business’s annual revenue. With a 5-year term (including 12 months of capital postponement), the BDC loan incurs no fees and requires meeting creditworthiness criteria. https://www.bdc.ca/en/canada-digital-adoption-program

Wage Subsidy for Hiring Talent:

CDAP program offers a wage subsidy of up to $7,300 for hiring talented students or recent graduates, aiding businesses in achieving their digital adoption goals. When combined with the CDAP grant and BDC loan, this funding package empowers businesses to successfully implement their digital adoption plans.

Understanding the Digital Advisor’s Role

A Digital Advisor serves as a key resource and guide for businesses participating in the Canada Digital Adoption Program. Their primary objective is to assist organizations in successfully adopting and leveraging digital technologies to enhance their operations, productivity, and overall competitiveness. By acting as a strategic consultant, the Digital Advisor helps businesses navigate the complexities of digital transformation, ensuring they make informed decisions and achieve their desired outcomes.

- Providing Expert Guidance. Under the Canada Digital Adoption Program, Digital Advisors offer expert guidance to businesses at every stage of their digital journey.

- Assessing Digital Readiness. One of the crucial responsibilities of a Digital Advisor is to assess a business’s digital readiness. By conducting comprehensive assessments, Digital Advisors gain a holistic view of the organization’s strengths, weaknesses, and opportunities, enabling them to develop targeted strategies for successful digital adoption.

- Developing Digital Transformation Roadmaps. After assessing a business’s digital readiness, digital Advisors collaborate with the organization’s stakeholders to develop digital transformation roadmaps. These roadmaps outline the steps and milestones necessary to achieve the desired digital goals.

- Providing training and workshops to enhance digital literacy among employees. As part of their role, digital Advisors deliver training sessions and workshops to educate business owners, managers, and employees on the effective use of digital tools. Furthermore, Digital Advisors offer ongoing support, addressing any challenges or issues that may arise during the digital adoption process.

- Monitoring and Evaluation. CDAP digital advisors continuously monitor and evaluate the progress of the digital adoption initiatives implemented by organizations. This feedback loop enables them to identify areas of improvement, make necessary adjustments, and ensure that the digital transformation journey stays on track.

What are Other Alternative Business Funding Avenues?

While the CDAP grant offers significant opportunities for businesses to fund their digital adoption plans, it’s important to explore alternative funding options in case you don’t qualify for the grant. Fortunately, there are several avenues available to secure financing for your business’s growth and expansion, such as:

Traditional Bank Loans:

Traditional bank loans are a common option for businesses seeking funding. These loans typically require collateral and a thorough application process. Interest rates and repayment terms vary based on factors such as credit history, business financials, and the amount borrowed.

Microloans and Community Development Financial Institutions (CDFIs):

Microloans and CDFIs are designed to support small businesses and entrepreneurs who may not meet the criteria for traditional bank loans. These lending options offer smaller loan amounts with more flexible eligibility requirements. CDFIs, in particular, focus on providing financial assistance to underserved communities and businesses.

Crowdfunding and Peer-to-Peer Lending:

Crowdfunding and peer-to-peer lending have gained popularity as online platforms connecting businesses with individual investors for funding. Crowdfunding involves offering rewards or equity, while peer-to-peer lending entails borrowing directly from individuals at agreed-upon interest rates.

Cubeler: An Alternative Solution

With the Cubeler Business Hub, accessing small business loans and other financing products is accelerated through AI. In just minutes, SMEs are matched with credit offers from top lenders, providing a streamlined and efficient funding solution. Here are the benefits of working with Cubeler:

- Speed and Efficiency: Cubeler’s AI-powered technology enables quick evaluation and funding decisions, reducing the waiting time typically associated with traditional lending processes.

- Access to Multiple Lenders: Cubeler connects businesses with a network of lenders, increasing the chances of finding a suitable funding option that aligns with your business’s requirements.

- Flexible Financing Options: Whether you need a small loan or a larger capital infusion, Cubeler offers a range of financing options tailored to your specific needs.

- Transparent Terms: Cubeler provides clear and transparent terms, ensuring that businesses have a comprehensive understanding of the loan terms, interest rates, and repayment schedules.

Conclusion

The CDAP grant provides SMEs with a valuable opportunity for digital transformation. For additional funding options, businesses can explore traditional bank loans, microloans, crowdfunding, or Cubeler. These alternatives offer diverse avenues to secure the necessary capital for business growth in the digital era.

Discover more about the CDAP grant

Related posts:

No related posts.