Credit unions play a vital role in the global financial ecosystem, providing services to over 375 million members and managing in excess of $2.3 trillion in assets. To maintain their competitive edge and offer superior member experiences, many are exploring the benefits of Zoho CRM, a highly versatile and robust platform. But the most important question is, is Zoho the right CRM for credit unions? And is it possible to tailor Zoho CRM to meet the unique needs and challenges faced by credit unions?

In this blog post, we’ll examine the potential of Zoho, one of the best CRM for financial services, discussing how it can be adapted to fulfill the specific demands of credit unions in order to facilitate seamless integration and elevate operational efficiency. Read on!

Zoho CRM Software for Credit Unions

Zoho CRM is built to help credit unions enhance operational efficiency, streamline member engagement and ramp up sales. In a nutshell, the platform is feature-rich, giving credit unions an all-around view of their members to understand their needs and match them with a personalized experience.

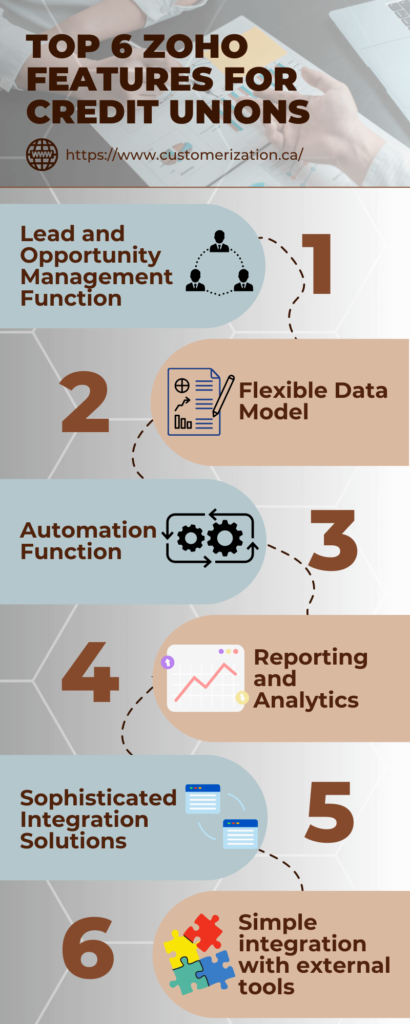

Top-tier Zoho features for financial services include:

- Lead and Opportunity Management Function. Credit unions can optimize the preliminary process of acquiring new clients with Zoho’s lead and opportunity management function. For instance, agents can leverage this feature to connect with potential members, effectively convert them into active members, and then turn them into loyal members with recurring revenue.

- Flexible Data Model. Flexible data models in CRM software for credit unions allow you to conceptualize various financial products and their relationships with clients. This approach allows you to develop unique models for managing loans, credit cards, or membership services.

- Automation Function. Zoho has various automation functionalities, including Assignment Rules, Approval Process, Workflow Rules, Actions, Blueprint, and Schedules. These features allow credit unions to automate routine tasks for optimized operations and focus on other productivity areas.

- Reporting and Analytics. The tool’s reporting and analytics functionalities make it a viable credit union software for monitoring customer service efforts, validating client information, and analyzing member behavior trends for quality lead generation.

- Sophisticated Integration Solutions. With the Zoho platform, credit unions can connect their customer relationship management system with other digital solutions to deliver an omnichannel experience. For instance, Zoho integration features like Zoho Flow can seamlessly connect with old bank systems to facilitate client data exchange. Other integration features include right-of-the-bat support for webhooks and Rest API.

- Simple integration with external tools. Zoho CRM is a component of the Zoho One platform, which has over 40 apps in addition to its sophisticated customization and integration possibilities. It covers all the aspects of digital transformation: marketing, meeting bookings, digital signature, document management, reviews, SMM integration, contact center (case management), etc.

Customizable Options in Zoho CRM

Besides the off-the-shelf features of a typical CRM in financial services, the Zoho platform allows credit unions to customize its functionalities in order to meet specific business needs. For example, you can tailor the following:

- Custom components that can be easily adjusted for the credit union’s needs, e.g., loan module, deposit account module, credit card module, membership etc. This provides a 360 view: all the assets a client has, his membership details, all the interactions, inquiries, statements, and more.

- Validation rules to implement conditions check for inbound data into the CRM, ensuring specific criteria are followed to match credit union industry standards.

- Custom views and filters to highlight the prospects who match predefined criteria so that your team can focus on them and convert them into spending customers.

- User field customization enables credit union representatives to access the record of viable prospects without necessarily changing their roles or permission levels. This saves time and enhances job experience as well.

Wrapping It Up

The Zoho features for financial services offer a range of customizable options to enable credit unions to evolve alongside dynamic consumer needs and match their expectations. Get in touch with Zoho CRM implementation partners today to integrate the solution and step up your customer service game for a competitive advantage.

Related posts:

No related posts.