Why Do You Need a CRM for Mortgage Brokers?

With a burgeoning demand for online mortgage broker services, mortgage broker companies and mortgage agents alike, MUST automate their operations and customer communications to scale further.

A CRM system is a piece of software that organizations use to automate tedious chores, manage client data and interactions, and simplify their sales processes. This implies that mortgage brokers need a platform that not only enables them to handle leads, track their pipeline, automate email marketing, maintain customer information organization, but also to manage the end-to-end applications processing.

Customer relationship management software helps you personalize interactions with every lead and eventually convert them into business clients. Moreover, when done right, the CRM becomes the ultimate tool that gives you the visibility into your clients’ applications managemnt. Just imagine, how much more productive your mortgage agents become when they dedicate most of their time actually managing clients and not tedousely typing same data into multiple software platforms!

An ideal CRM for mortgage brokers comes with tools and features that allow you to stay in touch with potential leads over time, give insights-driven advice, as well as establish trust and rapport. A CRM consulting expert specializing in mortgage broker and financial services business can extend your CRM functionality to cover the operational aspects of the clients’ applications management – from application submission to multiple lenders to tracking the applications statuses, to performance analysis, and more.

How to Choose a CRM for Your Mortgage Broker Firm

An innovative CRM tool can help you stay ahead of the competition, regardless of the size of your target audience. With that in mind, here is what to look for in a CRM software for mortgage brokers, especially if you’re planning to support multiple business functions, like sales, marketing, business operations, and support, with it:

Integration with Other Business Applications

This is one of the essential factors to consider because you’ll need a suite of other business tools as well to streamline all your operations. For instance, watch out for a tool that integrates with mortgage origination platforms your agents use.

Customization Options

Mortgage brokers have diverse needs and preferences when it comes to implementing digital business solutions. The CRM system you choose should have the ability to be easily updated or modified to match the requirements of your business – in the end of the day your firm has its own ways to get the job done.

User Experience

Evaluating a system’s user interface before integrating it with your business is important. In fact, 86% of business leaders double down on user experience when picking business tools. That said, your CRM tool should be intuitive with logical action flows to drive quick adoption. Don’t forget to run it through the agents who will be requested to use it every day.

Multi-Device Compatibility.

The best mortgage CRM allows your team to access it from any device, whether mobile, tablet, or PC. Multi-device compatibility enhances digital mobility, allowing you to access, manage, and close deals on the go.

Customer Support

Reliable technical support is a must-have component when implementing customer relationship management strategies. Ensure your vendor or/and implementation partner offers support packages for faster issue resolution and enhanced system performance through regular maintenance and optimization.

Security

Ensuring the security of your client’s data precedes everything else. Make sure that the CRM system’s security settings ensure that your customer information is protected. Ask for certifications that comply with your industry requirements.

Scalability

Pick a CRM system that can expand along with your organization and meet growing user and data storage needs.

Keeping these things in mind, let’s see how Zoho provides you with all of this as well as more useful tools to improve your efficiency.

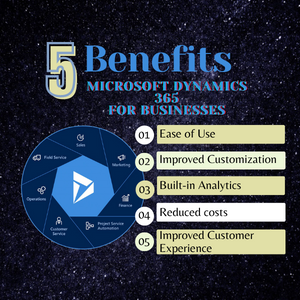

Zoho CRM for Mortgage Brokers: Features & Benefits

Now, when we’re convinced in the necessity of implementing a CRM tool for your mortgage broker firm, big or small, let’s look at the main advantages of using Zoho CRM for mortgage brokers:

Improved Visibility

Seamlessly track the applications of all mortgage seekers: each application’s status, agents working on it, and the subsequent actions are all trackable. With this degree of visibility, you can manage your firm effectively and make sure that nothing is overlooked.

Enhanced day-to-day efficiency

The platform may be linked with mortgage origination platforms like Finmo and Fiologics and customized to meet the needs of your company. Your firm will become more effective and efficient as a result of this connection since you will be able to monitor all the apps, their status, and the next steps in one location.

Keep track of all business opportunities

It enables you to set up notifications for renewals, tariff changes, and freebies. This application will make sure that you never, ever, miss a business opportunity. Essentially, it will help you fully capitalize on any chance to grow your firm.

Safeguard your clients’ data

You can save all of your clients’ data in one easily accessible, organized, and understandable location using Zoho CRM. You may use this data to gain insights that will enable you to make wise business decisions. You are the owner of this data, not a third-party platform

Security, compliance, and regulation

The ideal CRM for mortgage brokers should securely store data and communications and be compliant with legal and regulatory requirements. Zoho CRM has multiple certifications and compliance in place to ensure that your business is always fully compliant. You can research all the Zoho certifications here: https://www.zoho.com/compliance.html

Track Client Lifetime Value (LTV)

With Zoho CRM, you can keep an eye on the end-to-end acquisition costs and lifetime value (LTV) of your clients. You may utilize this data to determine the effectiveness of your marketing efforts, make good business decisions, and position your firm for growth.

Ramp Up Marketing Efforts

Thanks to the integration of marketing tools in the CRM, it becomes easy to categorize both existing and future customers. Once this is done, segment-specific marketing campaigns and journeys can be easily implemented.

Monitor the performance of your agents and lenders.

You’ll get access to the performance of your agents and lenders on a day-to-day basis and use this information to organize your business, come to intelligent judgments, and improve productivity.

Enhance Service Delivery

Zoho CRM enhances service delivery by allowing clients to reach you via multiple media, including web portals, SMS, social platforms, and direct phone calls. Moreover, you can track the status of each interaction to follow up on clients as much as needed.

Over to You

Implementing a CRM system is essential for all mortgage brokers who want to improve customer relationships and close deals faster. One of the best CRM for mortgage loan officers is Zoho, giving you an all-in-one platform with a user-friendly interface and endless customizable features.

A popular choice, Zoho CRM for mortgage brokers offers powerful features, affordability, and ease of use. By implementing Zoho CRM, mortgage brokerage firms can improve their sales process, increase productivity, and grow their business.

If you’re a mortgage brokerage firm own struggling with technology and automation and looking for Zoho CRM implementation partners, just reach out to Customerization and get started today!